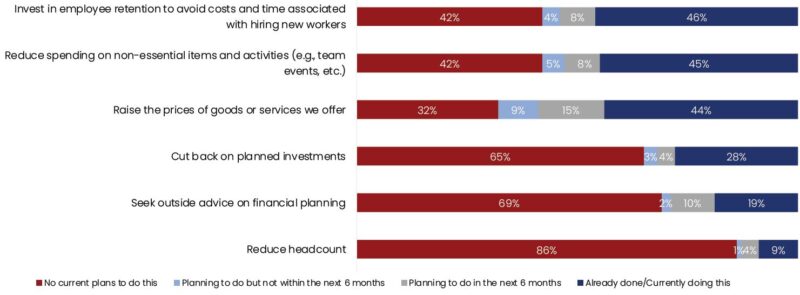

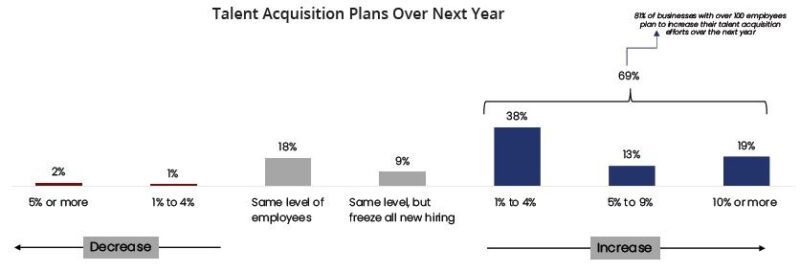

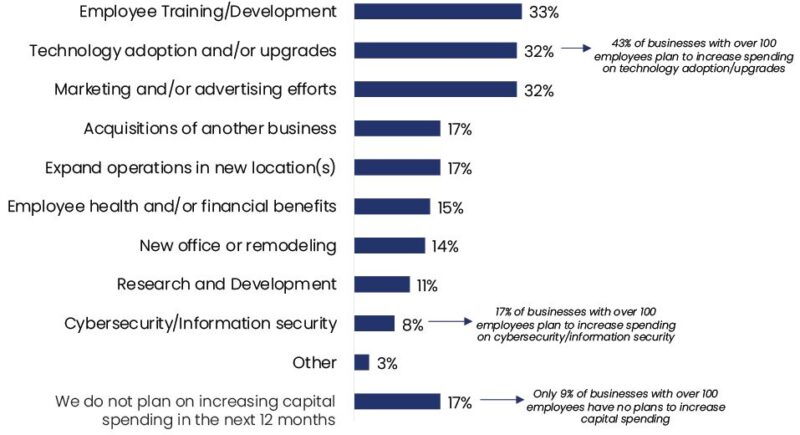

With top planned investments in employee training and development and technology adoption/upgrades for productivity and efficiency, businesses are reducing expenses for nonessentials and previously planned investments. However, one significant business strategy is acquisition activity. One-third of leaders in our survey are entertaining target acquisitions to grow their company and staff. Among businesses with more than 100 employees, the potential for acquisition activity is 43%.

Sales & Profitability Strategies

As anticipated in our last survey, executives are shifting their sales model. In the past, they were selling existing products to existing markets. Now, they are ready to sell new products and services to diversified customers and geographic markets. Optimism has rebounded to move forward with expansion plans even as companies limit certain investments or cut back on nonessential items and activities.

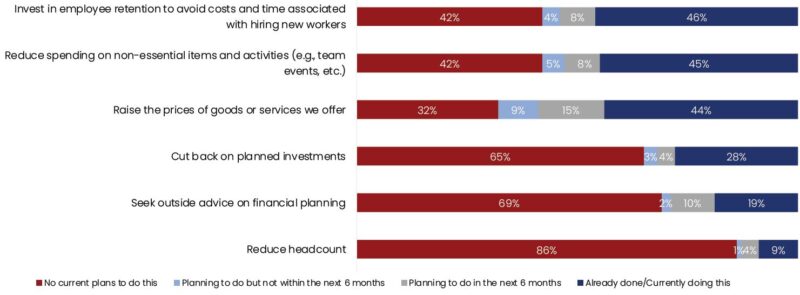

In response to inflation and increased costs, almost half of the businesses we surveyed have already raised the prices of their goods and services. Leaders also cite raising prices as a preemptive strike toward a future economic downturn. Increasing their cash flow and profits now can help them build reserves. Only 14% of businesses surveyed are considering taking on bank debt to support their growth strategies. However, 24% of employers with less than 100 employees did apply for a business loan or line of credit in the past year to cover costs and maintain their access to capital.

Roughly Half Have Already or Have Plans to Invest in Employee Retention, Reduce Spending on Non-Essentials, and Raise Prices of Their Goods/Services

Business Plans

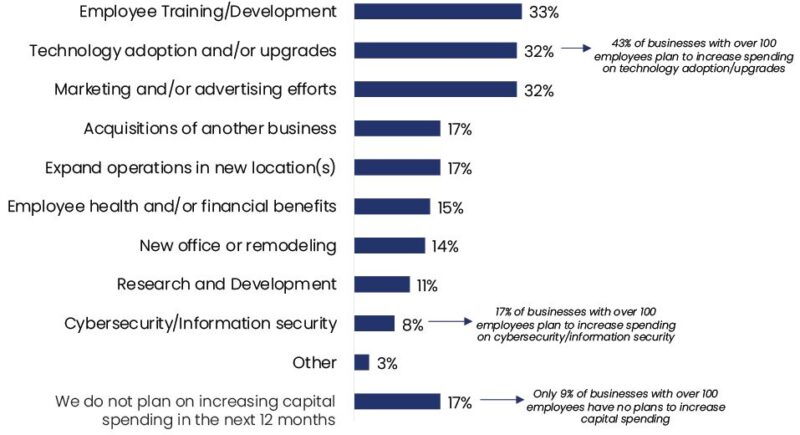

Capital Spending

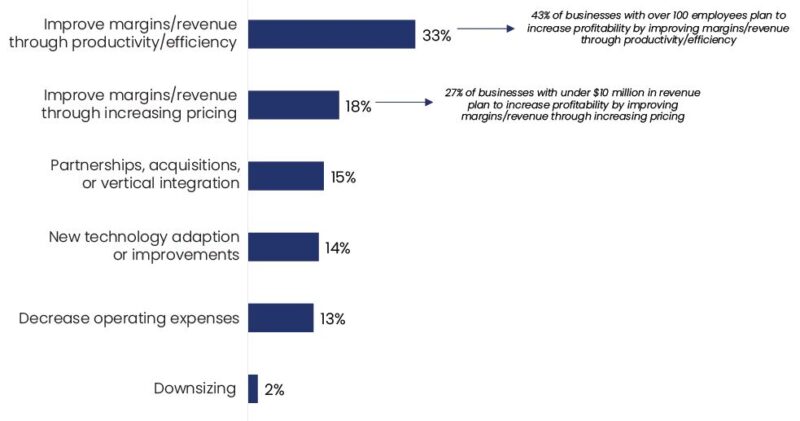

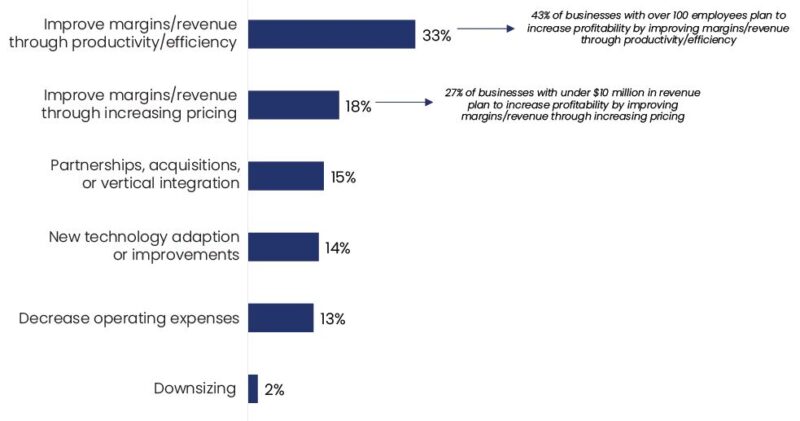

While larger companies with 100 or more employees are increasing profitability through spending on productivity and efficiency measures, companies with $10 million or less in revenue are mainly seeking profitability through increasing their pricing It is interesting to note that about 15% of leaders surveyed are investing in better employee health and financial benefits, likely to attract and retain talent.

Technology adoption and upgrades are a high priority for all businesses, including data analytics, AI, and cybersecurity/information security upgrades.

Acquisitions and expanding to a new location are among other plans for capital spending in the coming year.

“Is your firm looking to acquire another company? If you are, understanding the structure of the entity you are acquiring is important. A quick review of the organization type before LOI should indicate whether tax basis step-up will be difficult (or not even possible).” JAYME PARMAKIAN, CPA, SHAREHOLDER, TAX SERVICES

Areas of Focus for Capital Spending Include Employee Training/Development, Technology Adoption/Upgrades, and Marketing/Advertising Efforts

Areas For Capital Spending Increase Over Next 12 Months

Technology Enhancements

Technology adoption and upgrades are the second most important capital investment in the coming year across all industries, according to our survey.

Business executives view technology enhancements as a solution for improved margins as well as workforce shortages. Investments in technology include productivity and efficiency solutions, client service improvements and cybersecurity. There is continued interest in automation, business intelligence and AI for efficiency as well as customer service enhancements, but investment is varied across industries.

The Top Cited Plan for Increasing Profitability is Via Improving Margins/Revenue Through Productivity and Efficiency

Strategy for Increasing Profitability

“AI adoption is much like the adoption of any new technology or process in a company. Following a deliberate plan and taking measured steps in innovation are the key to unlocking AI’s potential. A good way to think of AI adoption is to apply a three-step approach:

- Strategize: Find the area or business process that is the best place to start with AI adoption. This would likely be a highly manual process or one that involves reviewing a lot of data or forecasting the future based on historical data.

- Organize: After finding that first business process, get your data “AI ” This means understanding how data flows through that process, who handles that data, and where it is stored. Next, the data needs to be organized and structured in the cloud to be available and accessible by AI models. As long as data remains scattered, unorganized, and stored in various systems, it will remain inaccessible to AI models. Think of data as the fuel for an AI engine.

- Apply: Start experimenting with AI, even with small subsets of This is about learning and innovating on a small scale to move into larger-scale applications.

You can follow this framework to scale AI across your organization. An additional strategy will need to be developed to create a roadmap of which business processes and areas you will address based on business prioritizations.” JON HILTON, SHAREHOLDER, CONSULTING & BUSINESS INTELLIGENCE

Mergers & Acquisitions

One third of companies across all industries in our survey are viewing target acquisitions as a solution for growth in the coming year. Interest in growth acquisitions is slightly larger for companies with 100 employees or more (43%). About 10% of companies across industries are open to merger activity specifically.

Regulatory scrutiny will continue to limit larger deals amid concerns about national security and competition. However, analysts see an increasing trend in smaller, industry-diverse M&A deals, meaning that companies will acquire complementary businesses to enter new markets and drive growth.

Private Equity Activity

Deal-making in 2023 is viewed as the start of a five- to eight-year growth cycle for private equity. Anticipating a sell-off of lower quality investments, PE firms will “bet on the bottom” despite lingering market uncertainty through 2024.

Only 5% of our business executives surveyed expect an infusion of cash from private equity firms; however, analyst predictions reflect the optimism of these executives to focus on growth and vision for 2024.

“On the PE/VC side, the rising cost of capital and market uncertainty are major concerns. As interest rates increased, it became more expensive to leverage acquisitions and investments, which could have led to lower returns on investments. Market volatility and uncertainty also makes it harder to accurately assess the value of target companies, which has resulted in delaying both acquisitions and portfolio exit plans.” JIM MEADE, CEO, LBMC, PC