“The applicability of sales taxes has been recently underestimated by many buyers and sellers, particularly within the healthcare industry.

There is a common misconception that healthcare is immune to the complexities of sales tax, but this assumption is far from reality. Durable medical equipment, prescription drugs, medical appliances, and healthcare diagnostic equipment often catch healthcare providers and suppliers off guard, as qualifications for sales tax exemptions in these areas are based on specific criteria that varies by state.

Another common misconception in the healthcare industry is that if a product or service is reimbursed by Medicare or Medicaid, then it automatically qualifies for a sales tax exemption. However, this is not always the case.

It’s essential for businesses in the healthcare industry to research and understand the specific tax treatment of their offerings in each state where they operate. For healthcare industry players as well as others, addressing sales tax issues is not just about compliance; it’s also about protecting your financial health.

Multiple years of incorrect compliance or inattention can generate significant and unforeseen sales tax liabilities. These liabilities can directly impact EBITDA, which is a critical metric in assessing a company’s financial performance.” LISA NIX, SHAREHOLDER, PRACTICE LEADER, TRANSACTION ADVISORY SERVICES

Labor Shortages

Clinical and nonclinical staffing shortages will persist through 2024, with high growth markets better able to weather the shortage by offering higher salaries and bonuses. However, cost of living and housing will remain factors in attracting and keeping staff.

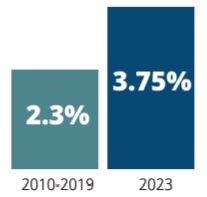

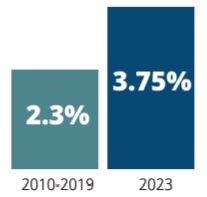

Employee Average Earnings Growth

Reimbursements

Significant changes among payers and within federal government programs are weakening the ability for healthcare organizations to negotiate higher reimbursements for services. This climate requires a focus on the payer mix, a clear understanding of regulatory updates and timely revenue cycling and billing practices.

“In healthcare organizations, business intelligence could be two separate functions (data acquisition and engineering as well as insights and intelligence). Most organizations can see the FTE time savings these functions can offer, but I would argue the real value to the automation effort is the ability for executive leadership, clinicians and operators to easily create or manage their own reporting tools.” BRAD MILNER, SENIOR DIRECTOR, HEALTHCARE ANALYTICS

Rising Costs

Whether they are dealing with labor costs, facilities maintenance costs, supplies or technology upgrades to satisfy new regulations, healthcare organizations are hit regularly with increased expenses. Current inflation and economic uncertainty are limiting gains from improved patient volume and new pricing models.

“The most common struggle for healthcare CFOs is the challenge of consolidations for multi-entity, multilocation organizations. Many of these CFOs are contending with the expansion of facilities and service lines across regions and states, changing accounting rules, growth via acquisitions and new ventures, and increasing activities between entities and the parent company. Converting to a cloud-based financial system tool can help address these challenges.” STACY SCHUETTLER, CEO, LBMC TECHNOLOGY SOLUTIONS

Growth Opportunities & Optimism

With an aging population and focus on proactive health and wellness, the healthcare industry has new opportunities to drive growth. Leaders in our survey were cautiously optimistic about their revenue prospects for 2024, and analysts note a more stable financial landscape. Interest from private equity and venture capital is high in the healthcare space, no doubt from the success of specialty care, wearable tech and wellness niches.

Traditional healthcare organizations can build alliances with these revenue generators to streamline the patient experience. One-stop offerings through strategic partnerships and seamless referrals extend the continuum of care and revenue.