Sales & Profitability Strategies

As more manufacturers must train their workforce on the job, there will be increased focus on streamlined training and development modules.

This may require more reliance on outside partners as part of new technology investment and implementation. In the coming year, we anticipate further investment in robotics, sustainable supply chains, and research and development. In the long run, these investments can produce efficiencies and innovation that allow management to focus more of their time on division strategy and growth.

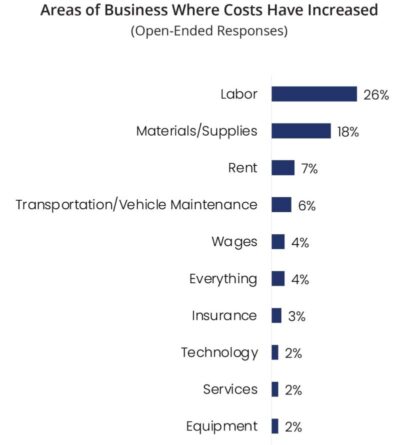

“M&D businesses should look for opportunities to stabilize and improve cash flows. For companies with multiple divisions and/or selling multiple products, a thorough analysis of gross and net margins can lead to decisions that produce higher profitability and increased cash flow. For many businesses, divisional and product line margins have been abnormal since 2020, with variable materials costs, increasing labor costs, and more expensive debt as contributing factors. Precise and timely cost accounting processes will help these companies navigate volatile and disruptive periods.” ANDREW J. USERY, CPA, CIA, CMA, AUDIT SERVICES SHAREHOLDER, MANUFACTURING AND DISTRIBUTION SEGMENT LEADER

Capital Spending

Capital spending will be down in manufacturing and distribution except for focus areas on employee training and development or efficiency tools. From our survey and CFO outlooks, CFOs want to improve inventory management, automate more business processes to cut down on manual labor, and create more agile teams with diverse skill sets.

“In the second half of 2023 there has been an increased focus on optimization. With much of manufacturing in the relative doldrums, a growing number of leaders are pulling back on discretionary spending, including on contractors and consultants, to hone in on what’s proven and profitable. Driving their thinking are higher labor costs and lingering supply- chain issues that have lead times still higher than where they were pre-COVID.

There’s really an element of getting the engine running on all cylinders; there’s not much concern among our clients about a serious economic downturn over the next two years. People are taking what’s working and focusing on that.

That includes getting more from relatively recent investments in both technology and workers. New software, including nascent artificial intelligence tools, and equipment haven’t been maximized, and staff hired since the depths of the pandemic are often just now hitting full stride. On the flipside, some leadership teams are abandoning projects that haven’t progressed as planned to safeguard some of their capital.

Things have stabilized, and now companies are looking for a return.” AARON HALE, SHAREHOLDER IN THE AUDIT DIVISION OF LBMC

M&A Activity

Small and mid-sized manufacturers will be the targets for M&A in 2024. Investors will go downstream for more reasonable deals while business executives seek growth opportunities by merging with or acquiring competitors.

Distribution companies have even more options with M&A, but they need to consider their entire operation in the deal to realize scale and ongoing growth — without sacrificing customer experience.