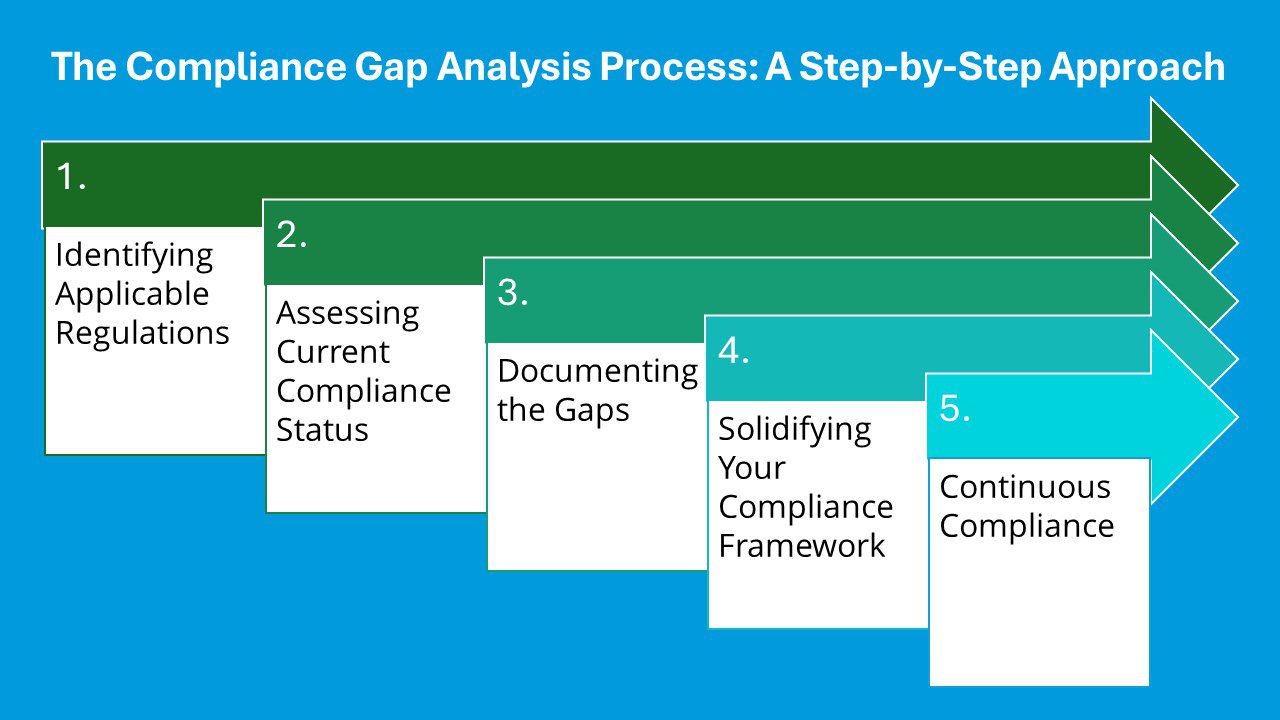

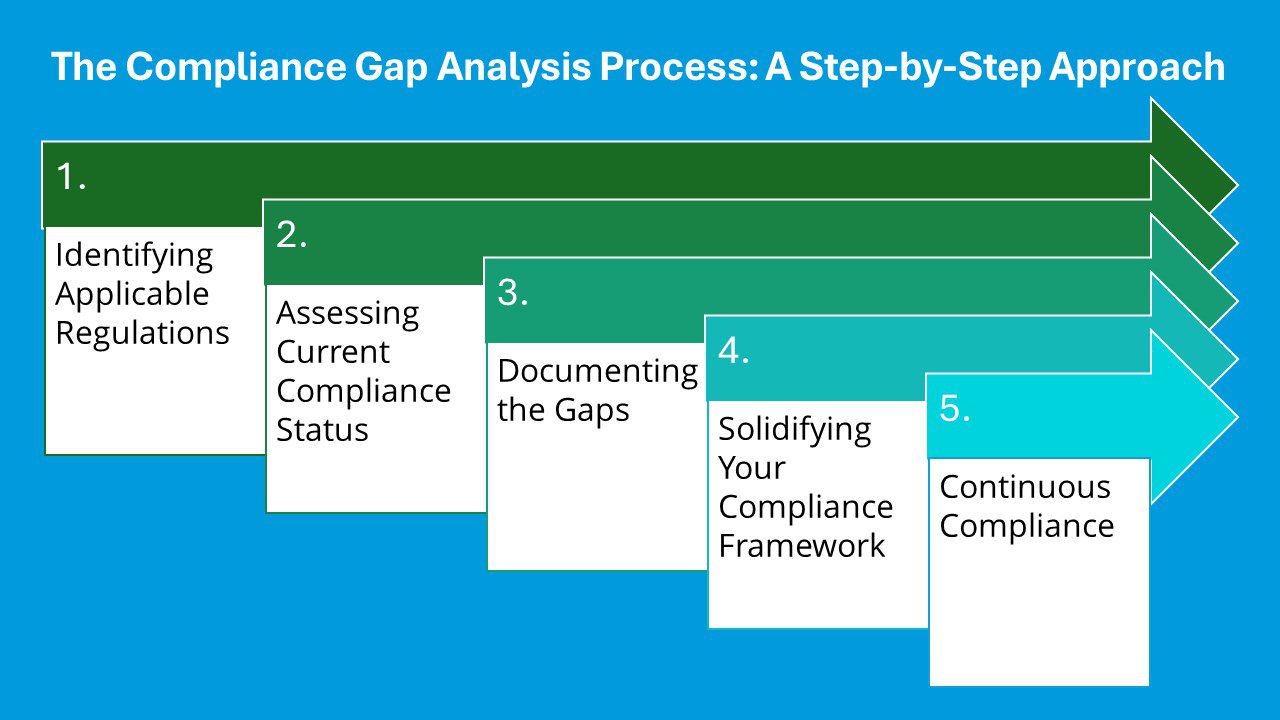

Compliance gap analysis must be done methodically if companies are to properly negotiate the challenging regulatory terrain. Finding the differences between an organization’s present activities and the legal requirements they must satisfy depends on this approach in great part. Clearly defining the actions in this process helps companies to make sure they not only follow relevant regulations but also are ready to apply the required adjustments to improve their compliance strategy. This part will walk you through the main phases of the compliance gap analysis process, therefore offering a clear road towards enhanced operational integrity and better regulatory conformity.

1. Identifying Applicable Regulations

Finding the particular laws, rules, and guidelines relevant to your company depending on your sector, region, and operating scope comes first in a compliance gap analysis. Accurate assessment of your compliance situation depends on this identification, which also forms the foundation for a focused compliance plan addressing certain regulatory requirements.

2. Assessing Current Compliance Status

Once relevant rules have been identified, the next phase is closely reviewing your company’s present policies, practices, and procedures. This evaluation shows areas where differences exist and how well these policies match required compliance criteria, so offering a clear direction for required corrections.

3. Documenting the Gaps

An efficient compliance gap study also entails painstakingly recording any variances between accepted norms and present methods. Developing focused remedial plans to remedy these gaps from this material provides a road map for compliance enhancement and responsibility.

4. Solidifying Your Compliance Framework

Making sure your company satisfies all legal criteria and handles any operational disparities depends on the compliance gap analysis method. Organizations can create strong plans to reduce risks and validate their compliance system by means of detailed identification of relevant rules, evaluation of present compliance level, and documentation of discrepancies. Apart from improving organizational compliance, this proactive strategy increases general corporate resilience against possible regulatory obstacles.