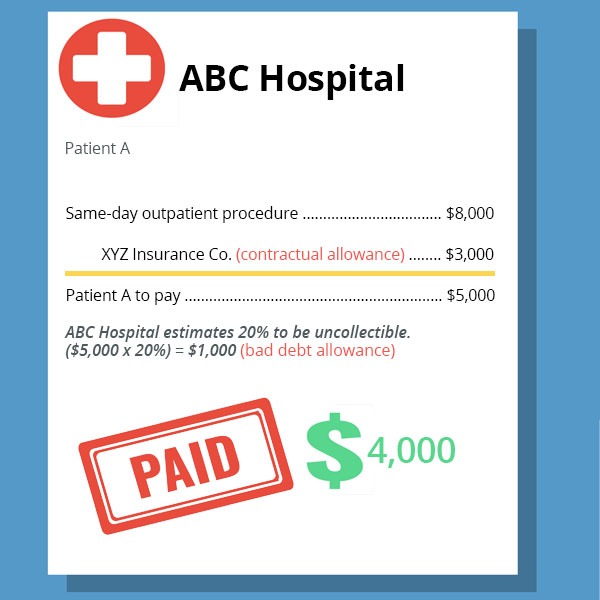

Allowances for bad debts are not deductible for tax purposes until the related accounts receivable are written off the taxpayer’s books and records as uncollectible after exhausting collection efforts (both internally and through third-party collection agencies). As a result, the IRS wants bad debt allowances clearly separated in tax returns and lumping them together with contractual allowances may cause the IRS to disallow a deduction for the entire amount.

To ensure proper tax return reporting, providers should make separate line entries for contractual allowances and bad debt allowances when compiling financial information. In arriving at net accounts receivable, the chart of accounts should contain accounts for gross accounts receivables, contractual allowances, and bad debt allowances. In arriving at net patient service revenue, the income statement accounts in the chart of accounts should have accounts for gross patient service revenue, contractual allowances, and bad debt expenses.

LBMC has helped many hospital systems and physician practices with their revenue recognition standards and tax reporting. We are a proven leader in healthcare with significant experience in the industry as evidenced by more than 300 healthcare related organizations ranging from multi-billion dollar organizations to smaller organizations. Learn more about the services we offer our healthcare clients.

Content provided by LBMC professional, Jayme Parmakian.

Jayme Parmakian is a shareholder in the tax practice at LBMC, a premiere Tennessee-based professional services firm. Contact Jayme at 615-309-2309 or jparmakian@lbmcstage2.webservice.team.

LBMC tax tips are provided as an informational and educational service for clients and friends of the firm. The communication is high-level and should not be considered as legal or tax advice to take any specific action. Individuals should consult with their personal tax or legal advisors before making any tax or legal-related decisions. In addition, the information and data presented are based on sources believed to be reliable, but we do not guarantee their accuracy or completeness. The information is current as of the date indicated and is subject to change without notice.