If I have heard my father say it once, I have heard him say it a thousand times, “The earlier you can start saving for retirement, the better.” It took me years to finally understand those words and see just how right he was. Similarly, how often do your children think about planning for their retirement? I can assure you retirement planning is one of the last things on the minds of individuals under the age of 18. But how powerful would it have been for you to learn about the power of saving at an early age?

Enter the custodial Roth IRA. A custodial Roth IRA is a retirement savings account funded with post-tax dollars for individuals under the age of 18. Much like a typical Roth IRA, money may be contributed up to $5,500 per year and grows tax-free for the individual’s lifetime. However, since you must be at least 18 to open a Roth IRA, the account must be set up with an adult as the custodian of the account. The custodian maintains control over the child’s custodial Roth IRA and helps make decisions about contributions, distributions, and how the contributions should be invested. All decisions must be made for the benefit of the child, and the child is the beneficial owner of the funds.

Once the child reaches the required age, 18 in most states, the account is transferred to a new account that is owned outright by the child, who becomes responsible for account management decisions from that point forward. Contributions are only allowed to the extent the child has earned income for the year. Earned income includes salaries, wages and self-employment income. Jobs such as mowing lawns, pressure washing, babysitting, or other entrepreneurial ventures do count, as long as they are paid at a reasonable rate. If your child’s income comes primarily from entrepreneurial ventures, be sure to keep detailed records including the type of work performed, when and for whom it was performed, and how much compensation was received. To contribute the maximum $5,500 in the custodial Roth IRA for the year, the child must have earned income of $5,500 during the year. For example, if they only have earned income of $3,000, they are limited to contributing $3,000. Remember to maintain all records of your children’s income as you will need to consider filing tax returns based on the level of income they receive each year.

Custodial Roth IRAs are not only financially beneficial for children, they also can help parents pass on valuable lessons, including strong work ethic, responsibility, accountability, and a sense of accomplishment. As children may be reluctant to set aside their hard-earned money to retirement savings instead of going to the movies on Friday night, anyone can contribute to the account on behalf of the child. However, the contributions in total must not exceed the earned income amount, or the $5,500 cap, whichever is lesser.

It’s important to note that any contributions by any individual other than the minor are considered gifts and may be subject to gift tax. The annual gift tax exclusion for 2018 is $15,000.

That means that if your child earns $3,000 during the year, you, or another adult in their life, can gift them a $3,000 contribution into their custodial Roth IRA account. The child can still spend their money however they wish, but you are rewarding them for their challenging work, teaching valuable lessons about saving and building up their retirement account. Another option would be to match their contributions dollar for dollar if they are willing to contribute their own money. The possibilities and conversations obviously vary greatly, but it is never too early to teach the value of earning and saving money.

While every individual and situation varies regarding how to tackle getting your children to work and save money, the one constant is that it’s never too early to start saving for retirement. Tools such as those found at www.bankrate.com can give children a visual of just how far saving a few dollars now can go in the future.

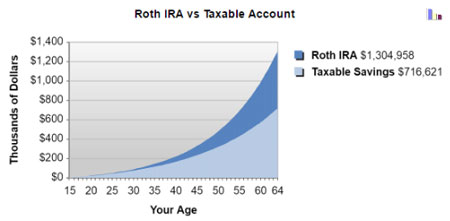

While everyone perks up at the thought of free money, showing actual numbers drives the point home. For example, if a 15-year-old were to start a custodial Roth IRA, and contribute $3,000 annually until they are 65 at an assumed rate of return of 7%, the total contributions of $150,000 during this period would transform into an estimated $1,304,958.

To further illustrate that starting sooner than later pays tremendously, compare the same facts to someone who starts contributions at age 25 into a Roth IRA. In this case, the Roth IRA is estimated at $640,829. An extra 10 years and $30,000 turns into an additional $664,129. While this is a hypothetical scenario, and results will vary based on the amount of contributions over the period of investing and the rate of return, the example demonstrates the dramatic difference ten additional years of compound interest can make.

In addition to the custodial Roth IRA, the custodial traditional IRA is an option as well. The primary difference between a custodial Roth IRA and a custodial traditional IRA is when the taxation takes place. For a custodial Roth IRA, post-tax dollars are contributed, which means no up-front tax savings, but the distributions are tax-free. A custodial traditional IRA is funded with pre-tax dollars, and the distributions are taxed when taken out.

With a custodial traditional IRA, individuals are eligible for an up-front tax deduction up to the contribution amount, which is capped at $5,500 per individual. Since the distributions are taxed when withdrawn from a custodial traditional IRA, the greatest benefit occurs when the individual is currently in a higher tax bracket than what he/she hopes to be in when they retire, and the up-front deduction helps reduce the current tax liability.

A custodial Roth IRA works the opposite way. In this case, the child is far more likely to be in a lower tax bracket now than in retirement. Oftentimes, children fall in the 0% income tax bracket due to filing requirements and thresholds.

Many children make less than that threshold, so they are in the 0% income tax bracket, and the up-front deduction with a custodial traditional IRA is not utilized.

In addition, one would assume that he/she will be in a higher tax bracket at retirement than when he/she is 15. Therefore, using the child’s post-tax dollars now, which are typically subject to 0% taxation as previously mentioned, to fund tax-free distributions when the individual will be at a higher tax bracket at retirement is a no-brainer.

In addition to the tax benefits, a custodial Roth IRA does not have required minimum distributions until after the death of the owner. Therefore, the money can stay in the account longer and can continue to grow versus a custodial regular IRA, which requires you to make required minimum distributions starting when you reach age 70 ½.

What happens if my child needs to use the funds in their custodial Roth IRA? All contributions made to a custodial Roth IRA are considered irrevocable transfers for the benefit of the child. Therefore, the custodian can withdraw contributions made to the child’s Roth IRA anytime, tax free and penalty free as long as they are used for the qualifying distribution scenarios listed below or for the benefit of the child. However, the child may have to pay taxes and penalties on the earnings withdrawn from the custodial Roth IRA unless they meet the criteria for a qualifying distribution. A qualifying distribution can be made under the following criteria:

- A withdrawal up to a $10,000 lifetime maximum can be made for a first-time home purchase

- The withdrawal is used to pay for qualified education expenses

- The individual is at least age 59 ½

- The individual becomes disabled or passes away

- The individual uses the withdrawal to pay for unreimbursed medical expenses or health insurance if unemployed

In addition to the above criteria, the custodian must then determine if the account the funds are being withdrawn from is 5 years old. If the withdrawal meets the above listed criteria, but the account is less than 5 years old, then the 10% early withdrawal penalty will not apply and the child will only owe tax on the earnings withdrawn. If the account is over 5 years old, then the earnings withdrawn would not be subject to penalties or tax.

Custodial Roth IRAs provide an alternative to 529 plans for college savings by allowing the student to make withdrawals for more than just qualified education expenses; if they never need to use the funds for education, they can be left to grow for their retirement instead. It is important to note that excess distributions are treated as untaxed income for financial aid purposes and could affect financial aid.

If you have additional questions, reach out to your tax professional at LBMC. LBMC Investment Advisors can assist you with establishing custodial Roth IRAs for your children. Reach out today!

LBMC tax tips are provided as an informational and educational service for clients and friends of the firm. The communication is high-level and should not be considered as legal or tax advice to take any specific action. Individuals should consult with their personal tax or legal advisors before making any tax or legal-related decisions. In addition, the information and data presented are based on sources believed to be reliable, but we do not guarantee their accuracy or completeness. The information is current as of the date indicated and is subject to change without notice.