Preventative Measures

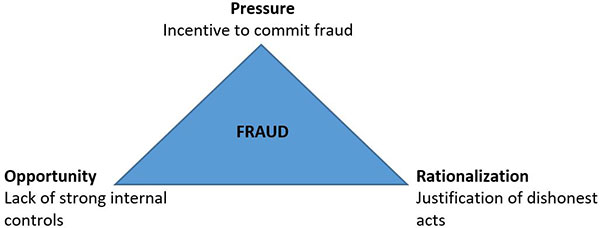

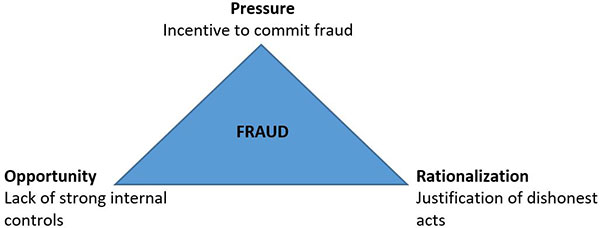

You may be familiar with the fraud triangle, but do the leaders in your organization have a solid understanding of how and why fraud occurs? While pressure and rationalization are external factors that most companies cannot control, opportunity results from a company having little to no internal controls.

Understanding and analyzing the opportunities available to your employees is critical in designing effective internal controls, which can assist in detecting and preventing fraudulent activity. Based on the ACFE’s study, in nearly one-third of fraud cases, the company lacked the appropriate internal controls to prevent fraud.

Implement the following anti-fraud controls to help prevent fraudulent activity and limit any losses your company could endure.

- Segregation of duties – Require more than one employee to complete a task.

- Management review – Review procedures performed by staff on a consistent basis.

- Hotline – Provide an anonymous anti-fraud telephone hotline for all employees to report suspicious behavior.

- Tone at the Top – Implement a code of conduct detailing expectations to serve as a reminder of what is expected from all employees.

While companies with well-implemented internal controls still may face fraud, potential losses should be limited by the controls put in place.

If fraud is discovered, take these steps

If your organization encounters fraud, the next step is to take appropriate action to recover the funds from the employee(s) or your insurance company (the most likely outcome).

Like many companies, your organization may not have the resources to continue everyday operations while investigating the fraudulent activity. So where should you start? Hire a firm with experience and credentials in forensic accounting (Certified in Financial Forensics “CFF” or Certified Fraud Examiner “CFE”). Forensic accountants analyze large amounts of electronic data using data analysis software (IDEA or ACL) while applying their expertise in the field. While each case is unique, a forensic accountant typically performs the following procedures:

- Interviews with key employees;

- Review of bank statements;

- Review of accounting records; and

- Review of specific journal entries through data analysis.

Through these steps, a forensic accountant can locate the perpetrator and determine how much monetary damage was done so your company can recover any damages incurred.

Conclusions

While every organization would like to mitigate fraud, there is no guaranteed way to avoid it. Implement strong internal controls and take a proactive approach to continuously update them, as technology and procedures are constantly changing and improving. Create a culture that expects employees to conduct themselves in an ethical manner, and foster an environment where employees are comfortable being uncomfortable. Make sure your employees always know someone on the management team is reviewing their work and holding them accountable. These steps will go a long way in preventing fraud and minimizing liability at your organization.