Nonqualified Stock Options (NSOs) are the most commonly used form of stock option. NSOs do not qualify for special tax treatments like incentive stock options, but they also have less restrictive provisions under the tax law. In the year of exercise, you are taxed at ordinary rates on the spread. The spread is the difference between the current value of the stock and your option price (also called strike/grant price). Federal income and employment taxes will be withheld by your employer at the exercise date. In the year of sale, you will be taxed at the capital gains tax rate on the growth of your stock after you exercise.

The decision of when to exercise your employee stock options can be challenging. There are important factors you should consider in order to make a wise decision.

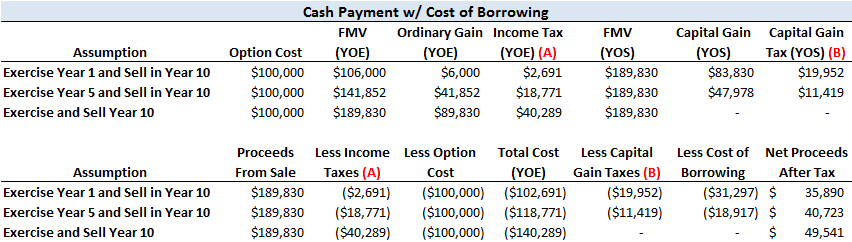

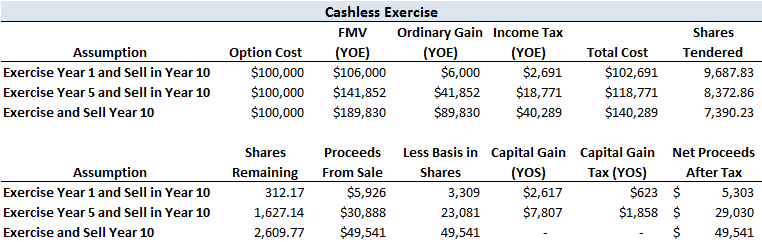

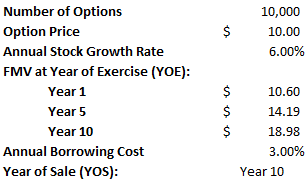

You have 10,000 NSOs available at $10, which are vested once received and expire in 10 years. Under each assumption, the option cost is $100,000 and the fair market value (FMV) is in the money. You are being taxed at the highest ordinary income rate (39.6%) plus Medicare tax (1.45%) and Net Investment Income tax (3.8%). Your capital gain rate is 23.8%. Since there is a significant difference between the ordinary income tax rate and the capital gain rate, let’s explore whether to exercise your options early or to exercise them closer to the expiration date. Any fees associated with selling have been ignored on the example.

You have 10,000 NSOs available at $10, which are vested once received and expire in 10 years. Under each assumption, the option cost is $100,000 and the fair market value (FMV) is in the money. You are being taxed at the highest ordinary income rate (39.6%) plus Medicare tax (1.45%) and Net Investment Income tax (3.8%). Your capital gain rate is 23.8%. Since there is a significant difference between the ordinary income tax rate and the capital gain rate, let’s explore whether to exercise your options early or to exercise them closer to the expiration date. Any fees associated with selling have been ignored on the example.