Most U.S. states have codified some protective aspect of the Corporate Practice of Medicine Doctrine (CPOM) into law to ensure medical and surgical physicians are free to make medical judgments in the best interests of their patients. These prohibitions generally prevent physicians from being employees of for-profit corporations, but they can create challenges when physicians in states like California, New York, or Texas want to pay third party management companies for physician practice management services.

Private Equity Deals Drive Management Arrangements

The recent wave of private equity investments in specialty physician practices has grown substantially over the past 10 years from primarily dermatology, gastroenterology, ophthalmology, and orthopedic specialty practices to also include vascular surgery and primary care, among other specialties. CPOM states are challenging for for-profit corporate operators, like private equity firms, that would prefer physicians to be employees, rather than independent contractors.

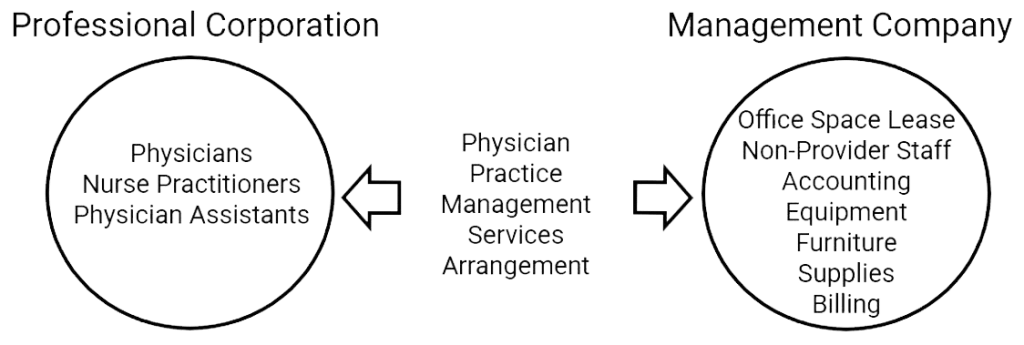

The CPOM restrictions are especially difficult to navigate when a physician practice wants to sell to a private equity firm. In these situations, the practices are limited to selling their tangible and intangible assets to the private equity firm’s management company and carving the medical and surgical professionals out of the deal into separate independent professional corporations that merely contract with the management company. The management company effectively holds the assets, office leases, and non-professional support staff of the practice, while the licensed physicians and advanced practice providers are employed by a separate professional corporation that contracts with the management company for comprehensive practice management services.

Two Ways to Structure Physician Practice Management Services and Fees

To comply with CPOM laws and physician fee-splitting prohibitions, these arrangements usually require management fee rates to be set in advance. They also may require fees be fixed rather than use a standard percentage of revenues or collections rate, as is prevalent in management service arrangements.

There are two main ways to structure physician practice management services and fees:

À La Carte Physician Practice Management Services

À la carte physician practice management services let independent physician practices pick and choose what services they want from a menu. This model works well for management service organizations that want to align with independent physician practices, i.e., those that might not be ready or interested in complete practice management outsourcing.

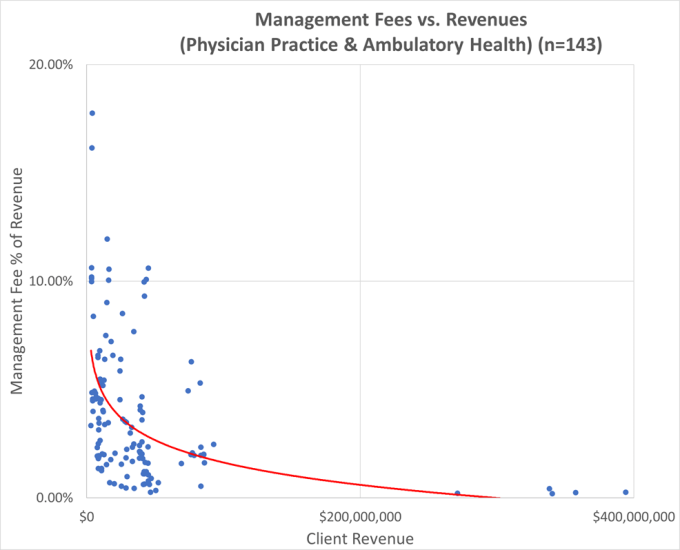

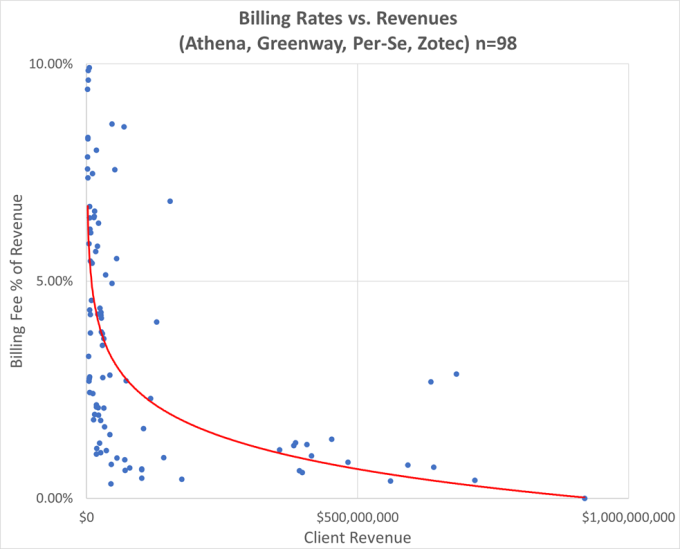

An independent practice can choose from any combination of services, including accounting, billing, payroll, staff leasing, practice management information systems, electronic health records systems, office space, equipment leasing, or supply chain management. The following charts show business management fees and revenue cycle billing rates charged by popular vendors to physician practices and ambulatory health organizations. This market data was identified in IRS Form 990 forms filed not-for-profit organizations.

Source: IRS Form 990 filings, Part VII, Section B, Independent Contractors

Source: IRS Form 990 filings, Part VII, Section B, Independent Contractors

The pricing for each individual service on the menu is broken out and is competitive with market rates for comparable services. Practice ABC may pay 4% of collections for billing services and 1% of gross payroll for staff leasing services, while Practice XYZ may pay a flat 20% of collections for financial management, accounting, billing, staff leasing services, and information systems.

Comprehensive Turnkey Practice Management Services

Comprehensive turnkey practice management is simpler and cleaner. Medical and surgical professionals are employed by a professional corporation, while unlicensed support personnel, assets, facilities, equipment, and supplies are furnished by the management company.

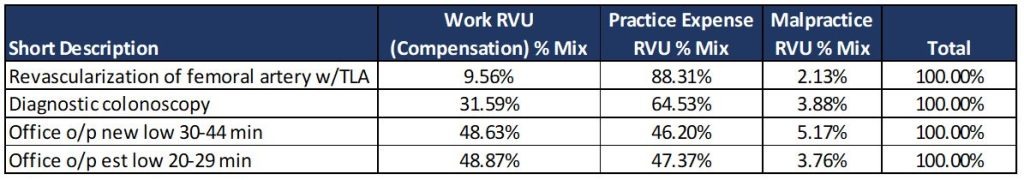

The clean separation of professional clinical services from all other practice expenses allows for the unbundling of reimbursement into its component parts. These include Work (physician compensation), Malpractice, and Practice Expense Relative Value Units (RVUs) for each clinical professional specialty and site of service on the basis of the Resource-Based Relative Value System.

Once the subject practice specialty is identified, the appropriate ratios of practice-expenses-to-reimbursement can be calculated from public billing data. The actual utilization of codes within each specialty is used to determine the appropriate weighting of practice expense ratios. Practice expense ratios can be used as a proxy for the management fee rates for each practice specialty.

Examples: Unbundling Physician Compensation & Practice Expenses (Office-Based)

This same work-to-total RVU or practice-expense-to-total RVU approach is also commonly used to unbundle radiology professional fees in global imaging center billing arrangements. In those cases, imaging centers drop global bills for imaging services, and then unbundle facility and professional service payments when they contract with independent radiology professionals.

The key to accurately unbundling professional compensation from practice expenses is using real billing data, either from the subject practice or for similar types of physicians and advanced practice providers.

Whether you offer à la carte physician practice management services, or comprehensive turnkey physician practice management services to professional corporations, LBMC’s healthcare valuation team can prepare Fair Market Value opinions for all types of arrangements with physician practices.

Contact LBMC today to have your physician practice management arrangements reviewed.

Nicholas A. Newsad, MHSA works in the Advisory Services Group at LBMC. He can be contacted at nick.newsad@lbmcstage2.webservice.team or 615-309-2489.