Key Takeaways

-

FASB developed ASU 2024-01 to improve clarity and offer thorough examples for the use of profits interest under ASC 718.

-

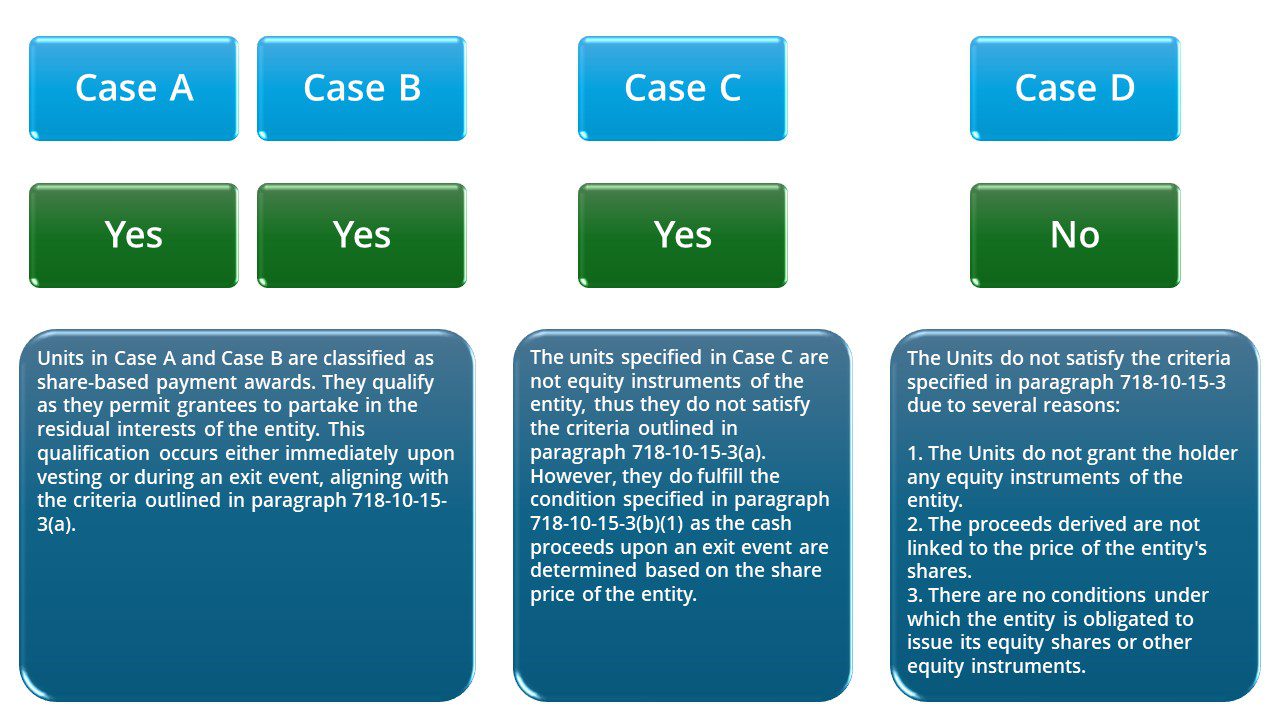

The update contains a new illustrative example that clarifies the scope advice for profits interest, therefore enabling businesses to properly apply ASC 718.

-

Reinforces the definition of profits interest via IRS Revenue Procedure 93-27 and describes its accounting consequences under various circumstances inside ASC 718 and 710, therefore supporting the definition of profits interest.