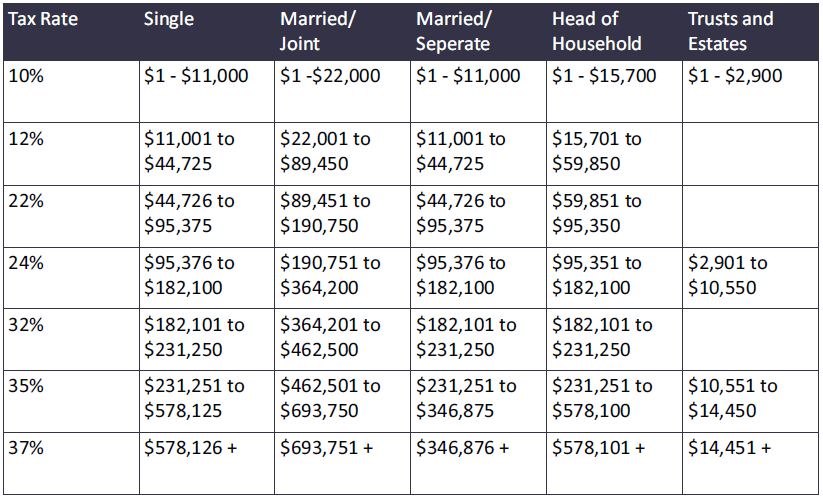

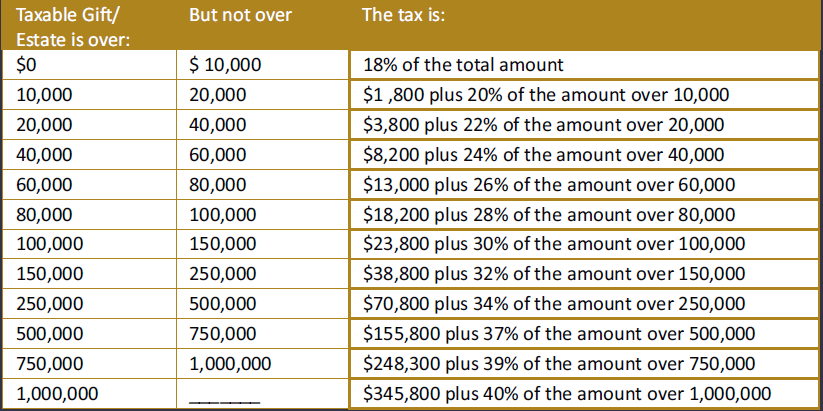

Ordinary Income Tax Brackets

Federal income tax brackets are indexed to increase with inflation. Historic levels of inflation in 2022 have caused the 2023 tax brackets to move up and spread out considerably. The 2023 federal income tax brackets for individuals and trusts are shown below.

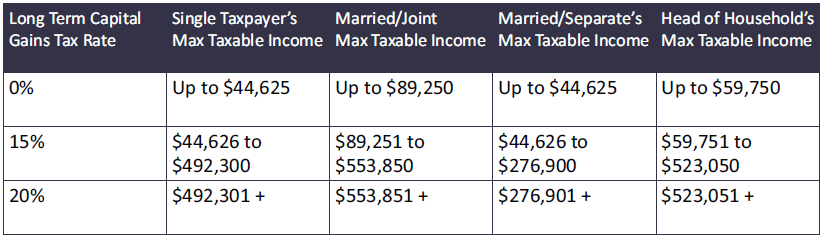

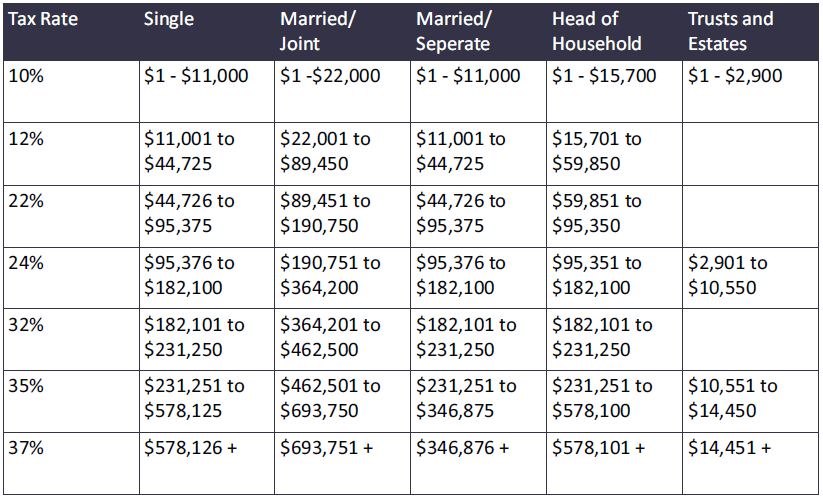

Long Term Capital Gains and Qualified Dividends Brackets

The long-term capital gains tax rates from 2022 still apply in 2023. Under the system created by the TCJA, the three capital gains income thresholds do not match up perfectly with the ordinary income tax brackets as they once did. Instead, the rates are applied to maximum taxable income levels, as follows:

As part of the Patient Protection and Affordable Care Act, unmarried individuals with modified adjusted gross income (“MAGI”) over $200,000, married couples filing jointly with MAGI over $250,000, and married filing separately with MAGI over $125,000 will also pay an additional 3.8% tax on “net investment income” on top of other taxes paid. This income typically includes interest, dividends, capital gains, rental and royalty income, and non-qualified annuities. The effect of this additional tax is that it increases the top effective rate on capital gains and qualified dividends to 23.8% (20% + 3.8%). This add-on tax also applies to all trusts and estates on the lesser of undistributed net income or Adjusted Gross Income in excess of the dollar amount at which the estate/trust pays income taxes at the highest rate.

Standard Deductions, Personal Exemptions, and Child Tax Credits

The TCJA substantially altered and revised the base level exemptions for the federal income tax: the Standard Deduction, Personal Exemption, and Child Tax Credit.

- In 2017, the Personal Exemption was $4,050 per person claimed on a tax return. The TCJA eliminated the Personal Exemption in 2018. The Personal Exemption is still set at $0 in 2022 and into 2023.

- The Standard Deduction is available for taxpayers who do not itemize their deductions. While the Personal Exemption was eliminated in 2018, the Standard Deduction was substantially increased. In 2023, the Standard Deduction is set to the following levels:

- Single: $13,850

- Married Taxpayers Filing Jointly: $27,700

- Married Filing Separately: $13,850

- Head of Household: $20,800

- Under the TCJA, the Child Tax Credit offered a static credit of $2,000 per child against taxes owed, with an inflation-adjusted portion refundable to the taxpayer. The American Rescue Plan Act, which passed in March 2021, substantially increased the Child Tax Credit to $3,600 per child aged 6 years or under and $3,000 per child aged 6 to 17. Moreover, this increased Child Tax Credit was in part preemptively refundable through monthly payments to parents. However, this increased Child Tax Credit only was only in effect during 2021 and was not renewed in 2022. As it currently stands, in 2023 the Child Tax Credit will once again be $2,000 per child up to age 16 with $1,600 refundable. The status of the Child Tax Credit may change before the end of 2022 as this tax credit gets more political attention than nearly any other item in the tax code.

Itemized Deductions — Limitations and Restrictions

While the Tax Cuts and Jobs Act of 2017 increased the Standard Deduction, it also substantially curtailed itemized deductions available to taxpayers. Consequently, many taxpayers who once itemized their deductions have opted in recent years simply to take the Standard Deduction instead or to pursue a more sophisticated tax planning strategy. The current status of common Itemized Deductions is as follows:

- Mortgage Interest has been specifically deductible since the Tax Reform Act of 1986 and remains so in 2023. Deductibility of interest on new mortgages is capped at mortgage debt of $750,000, down from the high point of $1 million mortgage debt in 2017. To take advantage of this deduction, a loan must be secured by a first or second home, and the loan disbursements must be used to construct, purchase, or improve the home that secures the loan.

- Home Equity Loans and Lines Interest is generally not deductible for either new or existing home equity loans or lines of credit. Home equity interest can still be deducted if it meets the rules stated above such that the home equity loan or line qualifies as a mortgage.

- State and Local Taxes are deductible to a capped amount of $10,000 in 2023. Taxpayers may deduct their state and local property taxes and either their state and local income taxes or sales taxes (but not both) up to the cap.

- Charitable contributions in 2023 are deductible as before, and the deductibility cap for cash contributions remains set at 60% of adjusted gross income. Contribution of non-cash assets remains at 30% or 20% of adjusted gross income, depending on charitable recipient.

- Medical Expenses for the taxpayer, spouse, or dependents are deductible in 2023 if such expenses exceed 7.5% of a taxpayer’s adjusted gross income and are unreimbursed from sources such as health insurance.

- Miscellaneous Deductions. The following expenses were once deductible, and may once again be deductible starting in 2026, but they are not deductible in 2023:

- Investment fees and expenses

- Tax preparation expenses

- Moving expenses

- Casualty and theft losses (except in federally recognized disaster areas)

- Job expenses (such as licensure fees, continuing education, regulatory fees)

- Subsidized parking and transit reimbursement

- Alimony payments

- Donations to colleges in exchange for athletic tickets or seating rights

Social Security and Medicare

All employee wages earned in 2023 are taxed at the 1.45% rate for Medicare. All self-employed earnings in 2023 are taxed at 2.9%, which includes both the employee and employer portions of the tax. Additionally, wages paid in excess of $200,000 for single filers and in excess of $250,000 for married filing jointly ($125,000 for married filing separately) will be subject to an extra 0.9% tax, making the top total rate of Medicare tax 2.35% for employees and 3.8% for self-employed individuals. There is no cap on the Medicare tax.

In 2023, the employee’s Social Security contribution rate remains set at 6.20%. The compensation level liable for full Social Security contributions is set at $160,200. This makes the maximum Social Security contribution for employees $9,932.40. On the other hand, in 2023, the self-employed individual’s Social Security contribution rate remains at 12.4%, which includes both the employee and employer contributions. The maximum compensation level liable for Social Security contributions is $160,200. This makes the maximum Social Security contribution for self-employed individuals $19,864.80.

Contributions to Retirement Accounts

The contribution limits for 401(k) as well as 403(b) and 457 plans have increased to $22,500 in 2023, up from $20,500 in 2022. Catch-up contributions for those age 50 and older increased to $7,500 in 2023, up from the 2022 level of $6,500. The contribution limit for SIMPLE retirement plans in 2023 increased to $15,500 in 2023, up from $14,000 in 2022. The SIMPLE catch-up contribution in 2022 is set at $3,500.

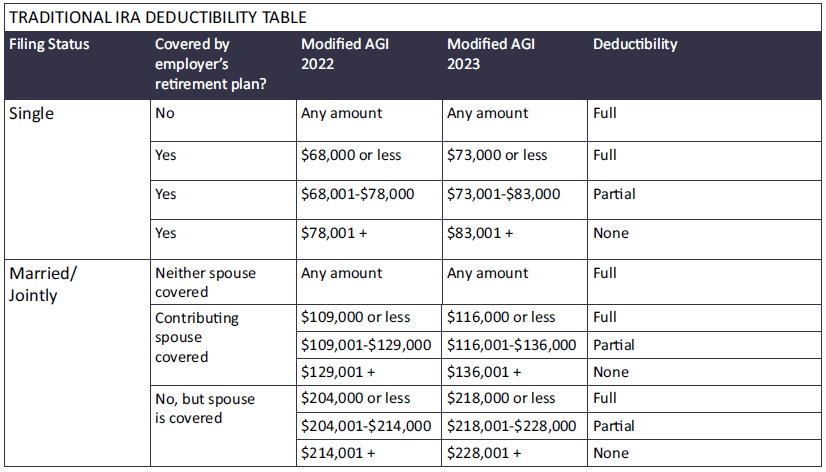

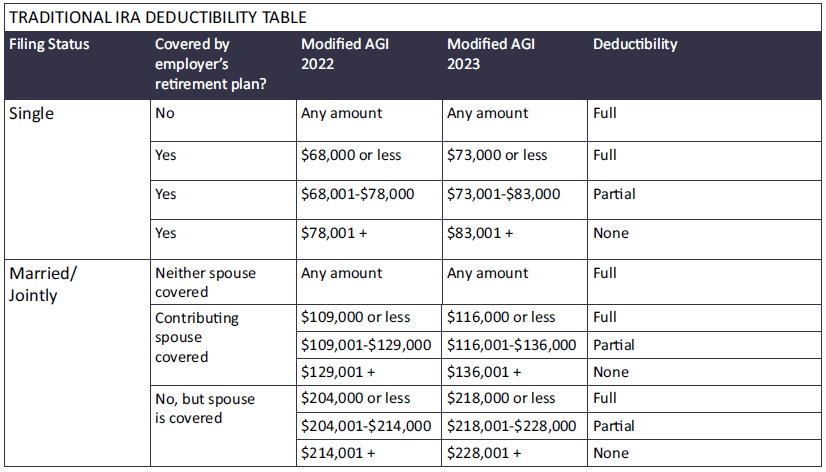

In 2023, the contribution limit for Traditional IRAs increased to $6,500, an increase from $6,000 in 2022. The catch-up contribution in 2023 for anyone age 50 or older by the end of the calendar year is not increased for inflation and remains firmly set at $1,000. The income phase-out limits that apply to Traditional IRAs contributions and their deductibility increased from 2022 to 2023, but are still constrained based on a contributor’s Modified Adjusted Gross Income and available coverage under an employer’s retirement plan. The 2023 income phase-out limits for deductibility of contributions to Traditional IRAs, and their relative increases over 2022, are shown in the following table:

In 2023, the contribution limit for Roth IRAs is also $6,500, with a catch-up contribution of $1,000 for anyone age 50 or older by the end of the calendar year, though contributions to Roth IRAs are not deductible. Contributions to Roth IRAs are also subject to phaseouts based on income, though these phaseouts are not as complex as for the Traditional IRAs. The income phaseouts for Roth IRAs in 2023 run from $138,000 to $153,000 for a single taxpayer and $218,000 to $228,000 for those filing joint returns. If a taxpayer is determined to make a contribution to a Roth IRA, but is above the income threshold, he or she may be able to “backdoor” into a Roth IRA contribution through a conversion from a Traditional IRA.

Alternative Minimum Tax

The Alternative Minimum Tax (AMT) is a backstop tax intended to prevent high income taxpayers from availing themselves of so many deductions and exemptions as to essentially mask their income and pay income tax at too low of a rate under federal tax policy. The TCJA substantially altered the AMT by raising its exemption and deduction levels, generally making it affect fewer taxpayers. The AMT is calculated in the following several steps:

- First the AMT exemption is applied against the taxpayer’s gross income. The AMT exemptions in 2023 are $81,300 for single taxpayers and $126,500 for married filing jointly. This is an increase from $75,900 and $118,100, respectively, in 2022. In the past, Congress would have to raise the amount of the AMT exemption every year to prevent unintended taxpayers to be drawn into the AMT under a phenomenon known as “bracket creep.” However, the TCJA and prior tax legislation put in place a permanent fix whereby the AMT exemption would increase every year, indexed with inflation.

- Following the application of the AMT exemption, the taxpayer is then allowed to declare some limited itemized deductions to reduce his or her taxable income. The AMT has far fewer of these limited itemized deductions available than does the standard income tax. The major deductions still allowed under the AMT are the mortgage interest deduction and the deduction for medical expenses, though a few other eclectic deductions are also available in limited amounts. The availability of these limited itemized deductions under the AMT also phase out as a taxpayer’s income increases.

- Once the taxpayer’s income has been reduced by the AMT exemption and the limited itemized deductions, the remaining amount is known as the Alternative Minimum Taxable Income (AMTl). The AMTI is taxed at a lower rate than the income tax. For 2023, the first $220,700 of AMTI is taxed at 26% and any excess amount is taxed at 28%. The application of the tax rate to the taxpayer’s AMT income determines the AMT tax.

- Since the AMT is a “backstop tax” that is intended to prevent taxpayers from reducing their taxes by taking too many deductions and exemptions, the AMT will not apply to everyone with income in the AMT tax range. Instead, as the last step in this computation, the AMT tax is compared with the standard federal income tax the taxpayer would otherwise have to pay under the tax law. If the standard federal income tax is greater, the taxpayer shall pay only that tax. And if the AMT tax is greater, the taxpayer shall pay only that AMT tax amount. The two taxes are never combined.

Estate, Gift, and Generation Skipping Transfer Taxes

From 2003 to 2010, there was an ongoing debate about the future of the estate and gift tax, two taxes that were intended to levy against the wealthy, but were increasingly affecting the middle class. With the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (TRA 2010) Congress established a compromise position for the estate and gift tax that made the estate tax exemption (which is also available for use against the gift tax and is commonly known as the Gift and Estate Tax Exemption) far more favorable to taxpayers than it had been historically, but in exchange sharply increased the rates of the Estate and Gift Taxes.

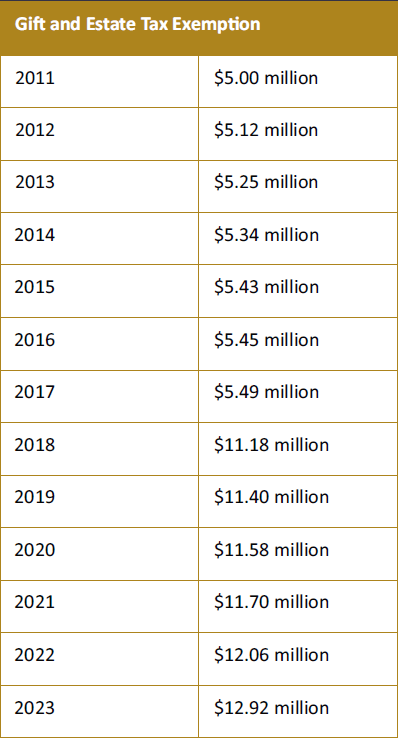

The TRA 2010 also brought the Estate and Gift Taxes into a much closer unity with each other than before by matching their rates and allowing for full use of the Gift and Estate Tax Exemption in life, at death, or some combination of the two. The Tax Cuts and Jobs Act of 2017 kept the fundamental structure of the Gift and Estate Taxes in place, but doubled the Gift and Estate Tax Exemption base from $5 million to $10 million (indexing with inflation). This allows a taxpayer to pass considerably more assets out of his or her estate, whether by gift during life or at death, than under the previous Exemption. However, as with most tax reform for individuals coming from the TCJA, the increase in the Exemption is temporary and is set to sunset in 2026 if Congress does not make the reforms permanent. After the sunset, the 2026 Exemption will once again be based on $5 million and indexed for inflation since 2010. The resulting 2026 Exemption is likely to be approximately $7 million per person, a substantial decrease from its current level.

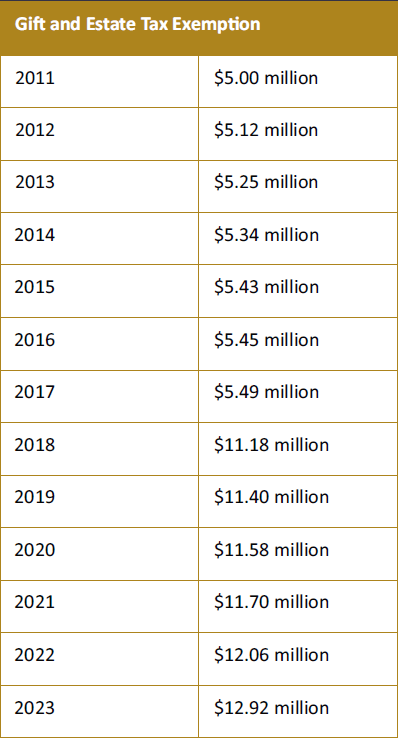

Any lifetime gift that exceeds the annual exclusion and any testamentary gifts not otherwise covered by an exclusion (such as the marital or charitable exclusions) shall encroach on the Gift and Estate Tax Exemption. The Gift and Estate Tax Exemption amount for 2023 is $12.92 million. However, in addition to increased flexibility of how the Gift and Estate Tax Exemption can be used during life and at death, the TRA 2010 also allowed the Gift and Estate Tax Exemption to be fully portable between husband and wife. This means that any unused Exemption of the first to die spouse can be used by the second to die spouse, even if neither spouse had estate plans specifically applying the Exemption, such as an “AB Trust” structure. This means that in 2022 a married couple can pass on $25.84 million to their heirs free from the Federal Gift and Estate Taxes with absolutely no planning at all. The amount of the Gift and Estate Tax Exemption increases annually for inflation, with a progression as demonstrated in the following table:

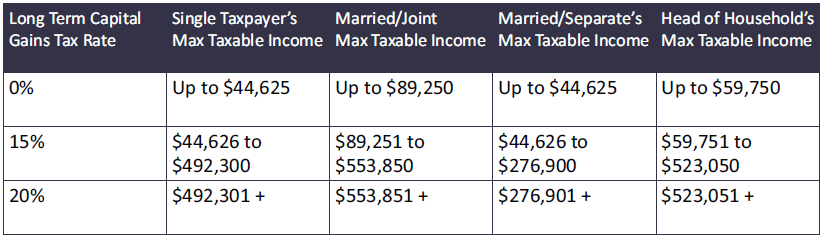

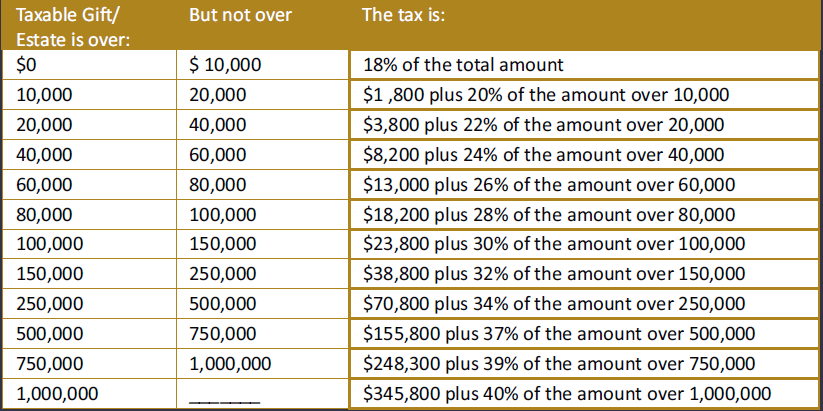

The 2023 Annual Exclusion for the Gift Tax is $17,000 per donor, per donee, per year. Gifts can be split between husband and wife such that the credit can become $34,000 per married donor couple, per donee, per year. There is no corresponding exclusion within the Estate Tax, which means that this annual exclusion makes lifetime gifts substantially more effective from a tax standpoint. The Estate and Gift Tax rates have been unified and are shown in the following table:

The TCJA also revised the Generation Skipping Transfer Tax (GST) by increasing its Exemption. Like the Estate and Gift Tax Exemption the GST Exemption has been indexed for inflation and is currently equal to $12.92 million in 2023. Unlike the Estate and Gift Tax Exemption, the GST Exemption is not portable and cannot be shared between spouses. This means that estate balancing remains important for taxpayers considering establishing legacy trusts or similar gifts. Any generation skipping gifts that exceed the GST Exemption (and are not otherwise covered by an exclusion provision) are subject to the GST. Recall that the GST is intended to act as a type of penalty for avoiding the Estate Tax, and therefore all transfers taxed by the GST are taxed at the maximum rate of the Estate Tax, currently 40%.

Social Security and Medicare