Accounting Standards Update (ASU) No. 2016-14, Not-for-Profit Entities (Topic 958) provides for certain improvements to current not-for-profit financial reporting. Upon adoption, a healthcare entity can expect changes to its financial statements with respect to the presentation of net assets as well as certain reconciliations within the statement of cash flows. Additionally, a healthcare entity should expect greater disclosures relating to its liquidity and availability of financial assets to meet future cash needs and the nature and functional class of expenses. The healthcare entity will be required to apply the changes within this ASU retrospectively to all periods presented. ASU No. 2016-14 is effective for fiscal years beginning after December 15, 2017. Therefore, most not-for-profit healthcare entities should be prepared to adopt this guidance for fiscal years beginning in 2018. Below is a summary of the improvements and changes a healthcare entity can expect upon adoption.

Improved Transparency of an Entity’s Net Assets and Liquid Resources

Prior to ASU 2016-14, issues were expressed related to the complexities that arise when classifying net assets between the currently required three categories of net assets. The following changes to a healthcare entity’s financial statements are expected to improve the categorization of net assets as well as the definition and meaningfulness of an entity’s unrestricted net assets.

- The currently defined categories of net assets include:temporarily restricted, permanently restricted, and unrestricted net assets. These categories will be reduced and simplified to only two categories – net assets with donor restrictions and net assets without donor restrictions.

- The common classification of “assets limited as to use” must now clearly distinguish between internally designated funds or externally restricted funds. This clarification can be accomplished through separate line items on the balance sheet or disclosed within the notes to the financial statements.

- Any amounts of cash and cash equivalents that are (1) restricted as to withdrawal or use for other than current operations, (2) designated for use of acquisition or construction of noncurrent assets, (3) required to be segregated for liquidation of long-term debts, or (4) limited to use for long-term purposes by a donor-imposed restriction should be reported separately on the face of the financial statements and excluded from classification as current assets.

Increased Disclosures Regarding Liquid Resources and Functional Expenses

This ASU also provides for enhanced disclosures for all not-for-profit entities, including not-for-profit healthcare entities. The improved disclosures should include qualitative and quantitative information to inform readers of the healthcare entity’s available liquid resources and communicate how the entity manages those liquid resources to meet general cash needs within one year from the date of the financial statements. The disclosures should address any limitations on the available resources due to the nature of the asset or internal or external restrictions imposed by donors, grantors, laws, contracts or governing boards. For any internally or externally restricted assets expected to be used to meet cash needs for the following year, disclosures should include justification as to their availability given the restrictions.

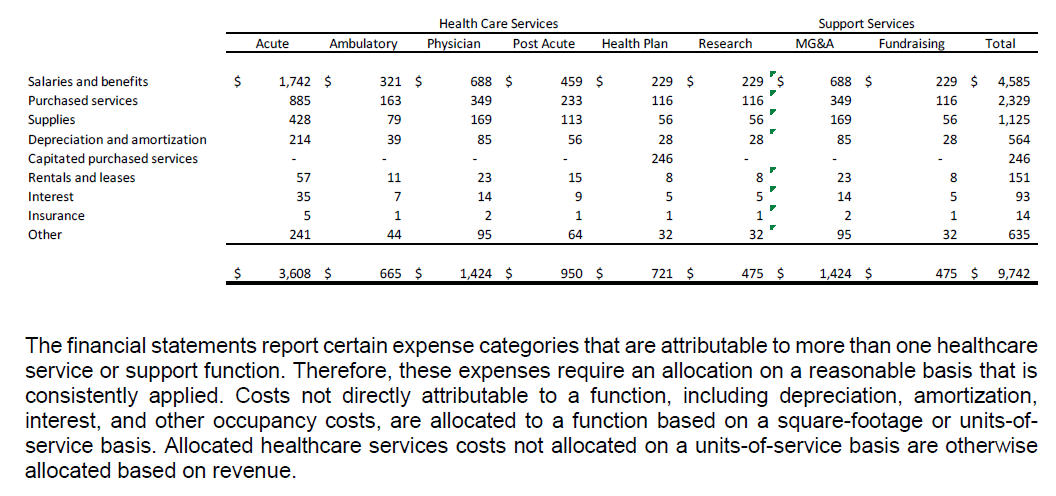

The improved disclosures should also include a more detailed presentation of amounts of expenses by both their nature and function. Currently, most healthcare not-for-profit entities disclose within the footnotes to the financial statements the breakdown of expenses by functional category alone. ASU No. 2016-14 will change the current practice by requiring the natural and functional classification of expenses to be provided in one location. This requirement can be met through the face of the financial statements, a separate statement, or in the footnote disclosures. Additionally, any expenses attributable to more than one program or support function, an allocation across the programs or supporting activities will be required. When applicable, the method used to allocate the expenses across the program and support functions should also be disclosed. Below is an example disclosure designed to meet the new requirements, which was obtained from the AICPA’s “Exploring FASB’s Not-for-Profit Financial Reporting Standard: ASU 2016-14, Supplemental Health Care Disclosure Examples: Natural and Functional Class Presentation.”

Elimination of Cash Flow Indirect Method Reconciliation

ASU No. 2016-14 is also changing the requirements for the presentation of cash flows. Current guidance requires a not-for-profit entity to present a reconciliation of operating cash flows using the indirect method of reporting when a direct method cash flow is presented in the financial statements. This standard will eliminate the required reconciliation using the indirect method if the statement of cash flows is prepared using the direct method.

With an effective date for fiscal years beginning after December 31, 2017, most healthcare not-for-profit entities should plan to adopt ASU No. 2016-14 for fiscal years beginning in 2018. An entity should expect modifications to its financial statement presentation and the related disclosures to enhance transparency, be more informational to users and reduce certain complexities. A healthcare entity should also begin assessing the capabilities of their current reporting software to ensure accurate information is available to support the enhanced disclosures and to ensure the implementation of the standard goes smoothly for both internal reporting leading into the organization’s year-end audit and external reporting.

For more information or to see if these changes will impact you, contact us.

Content provided by LBMC audit professional, Laura McGregor.