The U.S. Federal Reserve raised the federal funds interest rate 3% (300 basis points) during the first nine months of 2022 and set expectations for more increases through 2023. The recent and future changes to interest rates will affect valuations of ambulatory surgery centers (ASC) in a meaningful way. ASCs require millions of dollars of equipment and specialized facility improvements to operate. Even if an ASC has no debt, the cost of debt is still a major factor affecting its valuation.

Effects of Rising Debt Costs

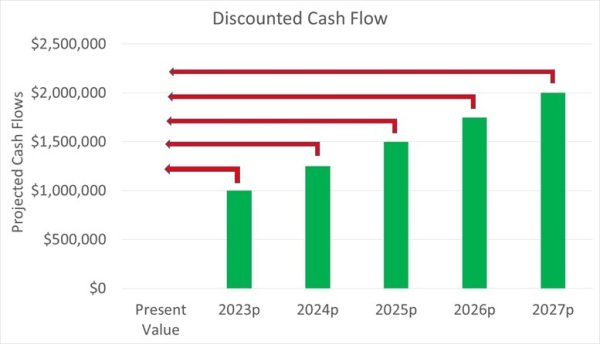

One of the most common valuation methods used to value profitable ASCs is the Discounted Cash Flow (“DCF”) method. A DCF projects future cash flows for a business, and then calculates a net present value of those future cash flows.

Appraisers must make judgements with ASC valuations as to what discount rates to apply in the net present value calculations. There are two main discount rates that can be used.

Required Rate of Return on Equity

When calculating the Value of Equity, the appraiser discreetly models out all existing debt payments of the ASC in the future projected cash flows, including principal and interest payments. When debt is discreetly factored into the cash flow projections, the appraiser applies a discount rate to the cash flows based on a Required Rate of Return on Equity. This represents the return-on-equity rate that investors demand for similar sized businesses with similar risk profiles. Various market studies and data sets are available to appraisers to support their selection of a Required Rate of Return on Equity. For small businesses worth less than $65 million, these equity return rates tend to range between 15% and 30%.

Weighted Average Cost of Capital

When calculating the Value of Invested Capital, the appraiser does not model out existing debt payments of the ASC in the future cash flows. Instead, the appraiser calculates a Weighted Average Cost of Capital that is a blend of the Required Rate of Return on Equity and a debt interest rate selected based on the appraiser’s judgement. Generally, the appraiser may select either (i) the actual debt interest rate the ASC is paying on its debt, or (ii) a market debt rate for the appropriate period.

With small businesses, the cost of debt (4% to 10%) is nearly always lower than the Required Rate of Return on Equity (15% to 30%). As appraisers assign more weight to the cost of debt, discount rates decrease, and valuations increase.

Depending on the assets and the actual debt profile of the ASC, appraisers commonly assign debt-to-total capitalization weightings ranging from 0% up to 40% or more. The difference in debt weightings in Figure 1 can alter the calculated net present value of cash flows of an ASC by millions of dollars.

| Equity Value Only | Weighted Average Cost of Capital | |||||

| Weight % | Rate | Weight % | Rate | Weight % | Rate | |

| Debt | 0% | 6% | 25% | 6% | 50% | 6% |

| Equity | 100% | 25% | 75% | 25% | 50% | 25% |

| Discount Rate | 25% | 20.25% | 15.5% | |||

If the Federal Reserve continues to make interest rate adjustments to curb inflation, those adjustments will affect the prevailing market cost of debt, and the selection and weighting of debt rates in the Weighted Average Cost of Capital will merit increased scrutiny. ASC owners are encouraged to have thoughtful discussions with their appraisers about debt rates, debt capitalizations, and their effects.

Breakeven & Unprofitable ASCs Increasing in Value

The cost of developing new ambulatory surgery centers (ASCs) has progressively increased over the past 15 years. Business valuations of breakeven and unprofitable ASCs are buoyed by the increasing cost-to-recreate them in the market. In this high inflation environment, ASC sellers should not underestimate their value.

Profitable ASCs are generally appraised under the Income and Market Approaches of valuation based upon some form of present value calculation of future earnings. Most ASC businesses generate annual cash flows that rival or exceed the appraised value of their physical assets. In these situations, appraisers acknowledge that the intangible value of business cash flows substantially exceeds the tangible value of physical business assets. The value of the tangible physical assets is understood to be a component of the total business value calculated under the intangible business valuation approaches.

Components of Business Value + Tangible Assets (Net Fixed Assets, Working Capital and Other Assets) + Identifiable Intangibles (Licenses, CONs, Tradenames) + Unidentifiable Intangibles (Goodwill) = Total Business Value

The Asset (Cost-to-Recreate) Approach of valuation is a practical approach for breakeven and unprofitable ASCs. According to construction industry cost data, the cost to construct the same 12,500 square foot ASC has increased about 74%, from about $3.6 million in 2006 to nearly $6.25 million in 2021.

This means that that a 15-year-old ASC that breaks even or loses money could have appreciated 74% on its original construction value if it was properly maintained.

This 15-year increase in the cost-to-recreate an ASC has been driven by increased costs in nearly every area, including plumbing (+110%), HVAC (+96%), contractor fees (+70%), architect fees (+69%), core and shell (+54%), electrical (+51%), equipment (+51%), and interiors (+50%).

Of course, an ASC that does not make reinvestments to replace and maintain HVAC systems, generators, and medical equipment will not realize full appreciation. Obsolete and unusable assets will detract from the value of the cost-to-recreate the ASC.

Under the Asset (Cost-to-Recreate) Approach, value may also be calculated for the cost-to-recreate intangible assets of ASCs, including the costs to obtain Certificates of Needs, state licenses, and Medicare certification.

It is a common misconception of operators of unprofitable surgery centers that their center has no value. Now more than ever, buyers are intrigued by the opportunity to purchase a turnkey ASC rather than incur the costs to recreate it. ASC owners and operators are encouraged to have thoughtful discussions with their appraisers about all the business valuation approaches. Contact LBMC’s experts in ASC business valuation and transaction advisory today to discuss the most appropriate valuation approaches for your ASC.

Nicholas A. Newsad, MHSA works in the Advisory Services Group at LBMC. He can be contacted at nick.newsad@lbmcstage2.webservice.team or 615-309-2489.