VDA’s Financial Implications

The VDA is especially important since it provides financial relief to hospitals whose operations could be hampered by unanticipated patient declines. Maintaining the continuity of services without sacrificing the quality of care given to the society depends on this assistance. The change not only addresses deficiencies but also offers a buffer that enables hospitals to strategically plan and carry out actions aiming at future stability.

Process and Timeline for VDA Claims

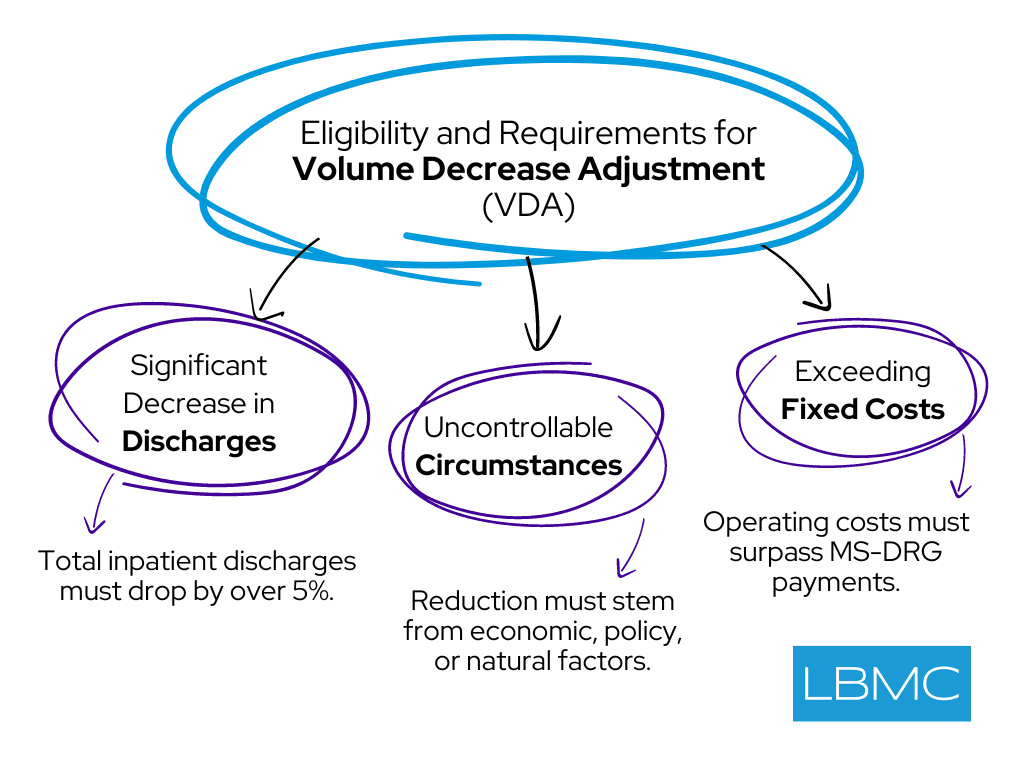

The process for claiming VDA involves a detailed submission of hospital operational data to Medicare, demonstrating the decline in discharges and proving that such changes were due to uncontrollable factors. Hospitals need to start this process as soon as the fiscal year data confirms eligibility criteria are met. The claim needs to be filed 180 days after receiving the NPR Notice of Program Reimbursement, hence quick action is quite important.

Strategic Significance of VDA

Beyond short-term financial comfort, VDA can be deliberately used to provide better long-term planning and resource allocation. The money might be used by hospitals to support against future uncertainty or to invest in important areas that were underfunded historically. Maintaining a strong healthcare system that can both meet expected and unanticipated difficulties depends on this strategic insight.